- Sent Items

- Posts

- Sent Items #211: Sunday, November 23, 2025

Sent Items #211: Sunday, November 23, 2025

Happy Thanksgiving Week! The fun is about to get started for those of us (i.e. most of us!) in e-commerce and logistics. Good luck to everyone out there!

I hope Shopify brings back their annual animated, data-visualization "globe" that they create to showcase real-time sales and stats during the BFCM period. Haven’t seen an announcement yet…

According to Adobe, U.S. e-commerce growth in October 2025 was an 8.2% year-over-year increase, reaching $88.7 billion in sales, driven by a surge in mobile spending (up 11.6%) and strong results from Prime Day events. Social media-driven sales grew significantly (28%), as did purchases from influencers and affiliates (15%). De minimis, tariffs and the like have had no impact on U.S. e-commerce spending. It’s fun building a business in a market that is growing at the consistently high rates that e-commerce is.

Another reminder that my friends at Manifest have given me the ability to offer Brands complimentary passes to their annual event at the Venetian in Vegas (Feb 9-11). Tickets are $2,795 so free is nice. Many of you attend this event, but for those who haven’t, Manifest is the premier event covering innovation, strategy and collaboration across the end-to-end supply chain. I’ll be there! If you're interested in a complimentary ticket (and are a brand) - or if you are a supplier and want a discounted ticket - just hit reply and I will connect you to their team.

Finally, since the holidays are upcoming, drop your mailing address here and you might just get a little something from me 🎁

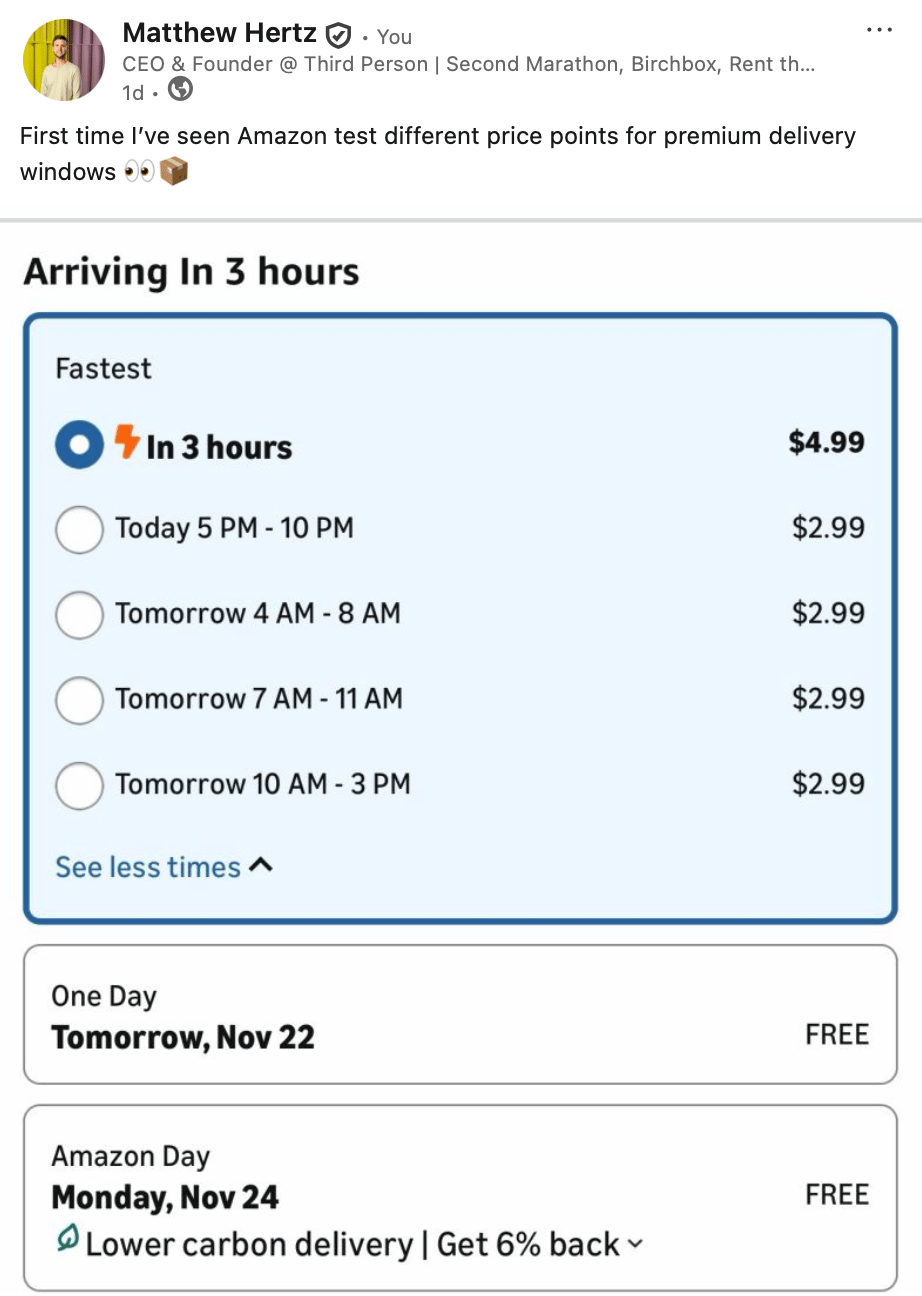

Speaking of things arriving, I was placing an order on Amazon Friday afternoon and was fed this dynamic delivery time test. First time I had been presented with delivery options at different price ranges with Amazon.

Interesting that Amazon seems to be getting into more of the “on demand” delivery game with promises of “within 3 hours”. Don’t see myself relying much on Amazon for “emergency” deliveries - Uber (Eats), DoorDash, Instacart and GoPuff fill that void quite well.

Our November edition of Matt’s Chats was recorded last Wednesday and it was 🔥🔥You can watch the replay below and I’ve shared a few of the key takeaways:

Black Friday Still Matters (but it’s evolving!): Black Friday remains significant despite dilution from year-round promotions. International shoppers are particularly active during Black Friday and Cyber Monday. The consumer psychology around holiday gifting and deals hasn't fundamentally changed, even as promotional periods have expanded.

Peak Season Preparation Essentials: Successful peak season preparation focuses on three main areas: labor and HR strategy with early hiring and training, IT systems with code freezes before peak periods, and preventive maintenance on material handling equipment. The preparedness reduces cognitive load during high-volume periods when some clients can see order volumes jump 10x.

Tariff Uncertainty Continues: While tariff announcements have cooled recently, uncertainty remains. The Supreme Court case regarding the administration's use of IEEPA powers to implement tariffs adds complexity, though operational leaders should assume status quo for planning purposes. Even if challenged, alternative legal frameworks likely exist for implementing tariffs.

Omnichannel is King: Brands are meeting customers wherever they shop - DTC sites, Amazon, retail partners like Ulta and Sephora, and even same-day delivery through DoorDash and Uber Eats. The traditional 2-3 day shipping model competes with instant gratification options, though new carrier options and zone-skipping strategies allow brands to offer two-day shipping at lower than ground pricing by major carriers.

Forecasting Remains the Biggest Challenge: Accurately predicting e-commerce volume is extremely difficult, with meteoric young brands sometimes delivering 4x their projections while established brands' marketing forecasts often need to be cut in half. International demand can be surprisingly strong and difficult to predict, especially for celebrity-founded brands.

Now onto some news...

Kroger abandons on-house fulfillment, pivots to third party partnerships (Reuters) Kroger is closing three e-commerce fulfillment centers and taking a $2.6 billion hit as it leans into partnerships with third-party delivery companies like Instacart, DoorDash, and UberEats as part of its efforts to rework its e-commerce strategy, and expects to improve e-commerce profitability by about $400 million in 2026.. This signals a broader trend of major retailers moving away from building their own fulfillment infrastructure in favor of leveraging established 3PL networks.

Tariffs Pushed Down U.S. Trade Deficit, Delayed Data Show (WSJ). Trump’s tariffs are showing an impact on the U.S. trade deficit, which shrank in August, the Commerce Department said last week. The new data gives a delayed look at how tariffs were shaping international trade flows over the summer. U.S. imports in August declined to $340.4 billion, a 5.1% drop compared with July. That yielded a monthly trade deficit of $59.6 billion, 24% smaller than the $78.2 billion deficit recorded in July.

Walmart CEO Doug McMillion to retire after 12 years (NY Times). Walmart CEO Doug McMillon is retiring in early 2026 after nearly 12 years at the helm, with current Walmart US head John Furner taking over February 1. McMillon's tenure saw transformation of e-commerce and supply chain operations that made Walmart a viable competitor to Amazon through pandemic disruptions, inflation, and trade restrictions.

Consumer anxiety threatens peak season fulfillment (Radial) U.S. consumer sentiment dropped to near-record lows in early November, and nearly 40% of consumers have abandoned brands they previously liked due to fulfillment failures. Gen Z (35%) and Millennials (33%) report the highest frustration with delays and lack of communication, while Boomers are more sensitive to unexpected shipping costs (33% abandon carts).

Home Depot signals retail slowdown with bleak 2025 outlook (Retail Brew). Home Depot expects profits to decline 5% year-over-year in 2025, citing consumer uncertainty, housing market pressure, and CEO Ted Decker noting that "affordability is a word that's being used a lot" with concerns about layoffs and job security. However, consumers are still willing to buy costlier items, with big-ticket transactions over $1,000 increasing 2.3% YoY.

Have a great week!

- Matt

Share this newsletter with friends and colleagues (link). Hit reply with any feedback and add me on LinkedIn and Twitter and subscribe to us on YouTube.