- Sent Items

- Posts

- Sent Items #195: Tuesday, July 15, 2025

Sent Items #195: Tuesday, July 15, 2025

Those who answered my call to donate to the devastating events in Central Texas - I thank you! I’ve learned that this newsletter community donated thousands of dollars 🙌

Thanks to those who tuned into our second monthly MATT’S CHATS webinar with my friends Mark Ang from GoBolt, Ben Emmrich from Tusk Logistics, and Rob Fraser from Outway. If you missed it, you can watch the conversation on our YouTube channel here:

I know no one has time for 45 minutes, so we posted a few shorts here (link).

New unboxing video out. This one with another favorite brand of mine (sic: favorite brand of my wife’s!) Sakara Life. A Masterclass in how to package perishable food effectively.

Finally, a couple quick PSAs:

Tomorrow I’ll be leading a session on 3PLs in the CPG space. You can register here (link)

rem

A reminder that I’ll be speaking at Shipstation’s Innovation Delivered event on August 7. It’s a free virtual summit. So many all star speakers, and then myself. Keynotes are Rebecca Minkoff and Christina Tosi (hi neighbor!) Be sure to register.

Now onto some news….

On Sunday U.S. stamps increased to $0.78, a jump of 5 cents, or about 7%. It is the 20th stamp rate change since 2000 and the seventh increase since 2021. In 2020 the cost of a forever stamp was $0.55. Today it is $0.78. Still feels like a steal to get something delivered thousands of miles away, but on the other hand, prices have increased 42% in 5 years. Arbitraging US Postal Stamps back in 2020 would have been a fairly savvy investment, certainly much better than buying CDs or Treasuries.

The USPS outlined a plan last year for twice-yearly increases, in January and July for both 2026 and 2027. I suspect the cost of a stamp will near $1.00 by Christmas 2027.

New Postmaster General Faces Pressure to Halt USPS Overhaul Amid Mounting Criticism (link).

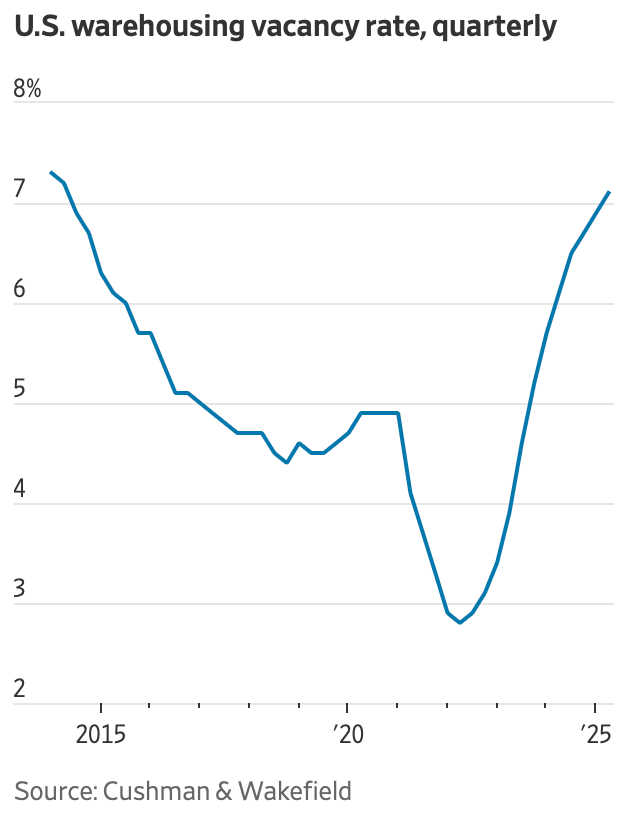

Warehouse Vacancies Climb to Highest Level in More Than a Decade (link). The U.S. warehouse vacancy rate rose to 7.1% in the second quarter, the highest in 11 years, due to trade policy changes. Companies paused leasing due to tariff uncertainty, opting to use existing space for inventory. Despite rising vacancy, rents increased by 3% year-over-year, driven by long-term leasing strategies in the industrial sector.

Retailers, manufacturers and wholesalers built up stockpiles of inventory ahead of Trump’s anticipated tariffs, then pared back overseas orders and paused leasing decisions as the duties were announced. The industrial real-estate sector has struggled for three years with climbing availability due to weak demand and an influx of newly built space, following a period of frenzied expansion in warehouse construction and leasing during the pandemic that drove vacancy down below 3%.

The amount of U.S. warehouse space listed for sublease reached a record high of more than 225 million square feet in the second quarter, up 25% from the same period a year earlier, according to real-estate services firm Savills. Developers have pulled back on new construction amid weakened demand. About 72 million square feet of newly built space became available in the second quarter, down 45% from the same period in 2024.

Rents continue to rise even as the vacancy rate has climbed. Prices haven’t receded because of the particular dynamics of the industrial real-estate market, where warehouse operators and their customers often base their leasing decisions on long-term prospects rather than short-term market conditions. The overall net rent increased to $10.12 per square foot in the second quarter, up about 3% from the same period a year earlier.

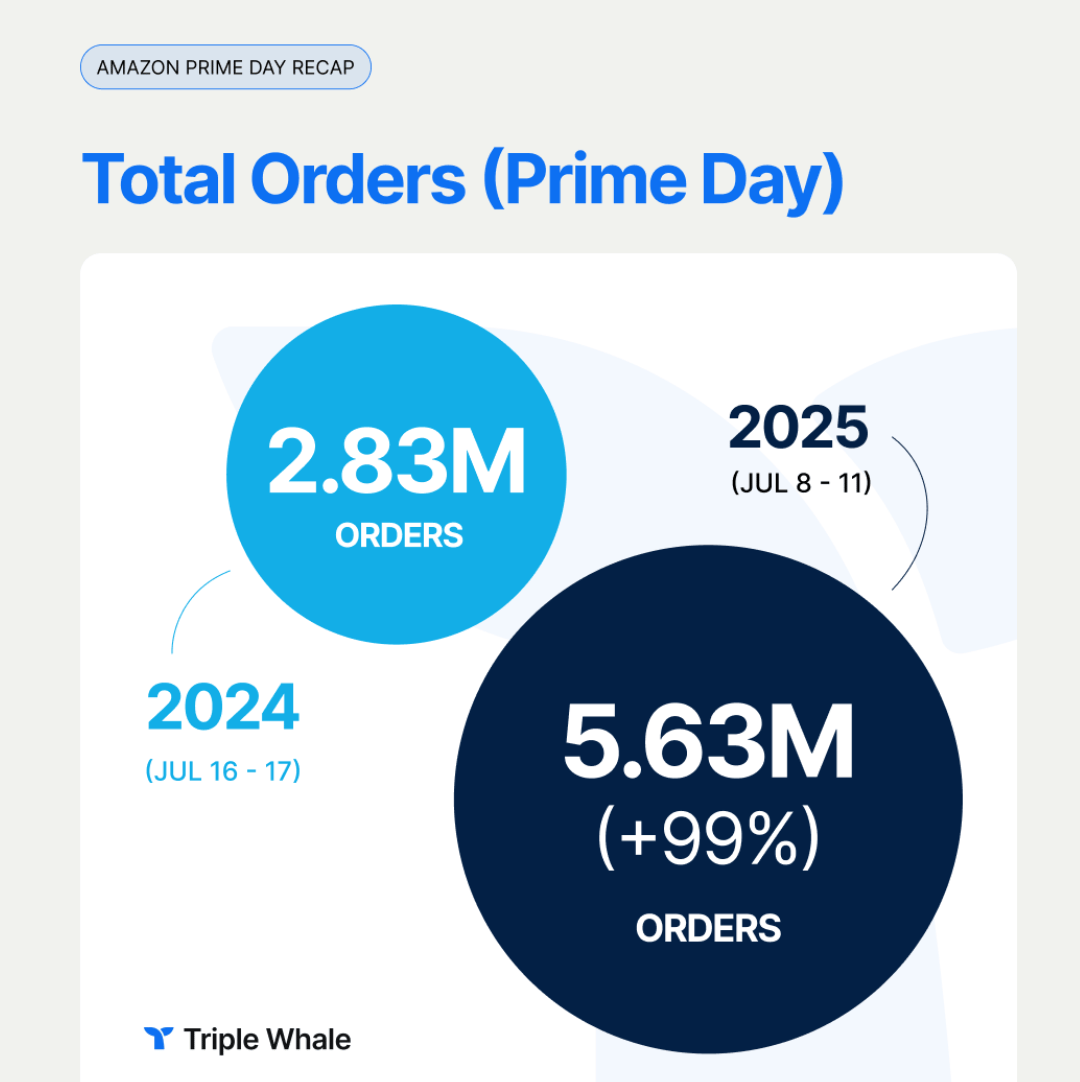

Prime Day event drove over $24B in US e-commerce sales. According to Adobe an analysis of the U.S. retail landscape encompassing over 1 trillion visits to U.S. retail websites, including 100 million SKUs across 18 product categories, during the Amazon Prime Day event (July 8-11), U.S. retailers saw $24.1 billion in online spend, representing 30.3% year-over-year growth, or the equivalent of two Black Fridays.

Amazon didn’t share specific Prime Day figures, only saying that it was the biggest event ever with record sales and more items sold than before. However, the company also expanded Prime Day to a four-day event this year, making comparisons to prior years difficult.

According to Triple Whale, total orders were up 99% from last year, albeit the event was extended from 2 days to 4. However, net revenue only grew about 29% (30% according to Adobe) which means people are buying more, but spending less per purchase. AOV dropped 35% from $64.87 to $41.94. One key observation was there was less discounting, with brands pulling back on promos. Margin protection was a clear priority.

If you still don’t understand the real impact of tariffs - or simply want some sympathy that it’s not only happening to you - here’s a fascinating read on how a luggage maker in Colorado, Eagle Creek, is dealing with them (link).

The bulk of Eagle Creek’s luggage, packing cubes and duffel bags are made in Indonesia. The levies, set to go into effect on Aug. 1, meant that imports from Indonesia would be subject to a tariff of 32%, an extra cost that would pose a significant challenge for the rugged, 50-year-old company.

Three shipping containers with about $240,000 worth of the manufacturer’s goods were set to arrive at the Port of Los Angeles on July 30, just before the new tariffs are expected to kick in. A delay of even a few days could result in additional fees of at least $52,000.

Even if Trump’s new tariffs never switch on, their chaotic rollout has forced businesses across the country to rethink their supply chains, which in some instances are complex and difficult to untangle. Many companies have curtailed hiring plans, delayed projects and generally hunkered down in a way that could have significant implications for the broader economy. Unable to plan for the future without having a firmer view of its expenses, the company paused hiring and salary increases, and it cut back its spending on marketing. Investments in research and development, including for a new product line that the company had hoped to introduce next spring, have been frozen.

Because of the categories of materials it imports, Eagle Creek — which also makes about 5 percent of its products in Vietnam — already pays tariffs of between 17.6 and 20%.

But when Trump revealed his initial rates in early April, which included a 32% tariff on goods from Indonesia and 46% on Vietnam, the incremental $800,000 cost to Eagle Creek on its existing orders was so staggering that the company paused everything.

Couldn’t help but see this headline: Seattle startup raises $6.3M to pick up your used stuff for free — and turn it into a resale marketplace (link). Has it really been that long since Shyp failed? 😬 Free pickups of trash? Their own vehicles, people, and warehousing? Yikes! I wish them luck, but this feels like a disaster.

- Matt

Share this newsletter with friends and colleagues (link). Hit reply with any feedback and add me on LinkedIn and Twitter.